ISSUES

: Business and Trade

Chapter 2: Corporate responsibility

29

Supermarkets: is it the end of an empire?

N

ews that the ‘Big Four’ major

British supermarkets are

experiencing massive losses

has become so ubiquitous in recent

months it hardly seems newsworthy

anymore. The most spectacular

fall from glory has been Tesco’s

– the retail behemoth that, at the

height of its market domination,

was present in every postcode in

Britain and pocketed one in every

seven pounds spent in the country.

It recently reported a loss of £6.38

billion, the biggest loss in UK retail

history. It is currently under criminal

investigation by the Serious Fraud

Office for fiddling its accounts

while simultaneously being cross-

examined by the Groceries Code

Adjudicator for bullying its suppliers.

Meanwhile, Sainsbury’s reported

its first loss in nine years to the tune

of £72 million, profits at Morrisons

were down 52% and Asda recorded

its worst performance in 20 years.

While forlorn CEOs scratch

their heads and speak in grave

tones about their companies’

previously unthinkable free fall,

communities and independent

retailers who have long struggled

against the supermarket monopoly

are watching on in satisfaction.

Traditional markets, small shops,

box schemes, farmers’ markets

and food co-ops are thriving and

becoming mainstream alternatives

to the supermarkets, having been

dismissed for years as hopelessly

nostalgic or exclusively for a right-

on and privileged minority. And for

urban customers of modest means

who arrive on foot, stores set up

by immigrants increasingly look

like plausible, budget alternatives

to supermarkets. So much so that

in gritty Toxteth in Liverpool the

L8 Superstore – a sprawling local

emporium renowned for its exciting

market-style display of fresh fruit

and vegetables outside and its

United Nations’ of dried goods

within – was recently named Food

Retailer of the Year in the BBC

Food and Farming awards. As

owner Abdul Ghafoor puts it, “We

have everything here that everyone

local needs” from fruit and veg to

nappies. Tellingly, last bank holiday

weekend local high streets and their

small businesses enjoyed a surge in

visitors, while footfall at sprawling

out-of-town retail parks was down.

Yet it is the German discount

supermarkets Aldi and Lidl, not

the independent shops, that are

credited with dealing the fatal blow

to the Big Four and shaking up

the food economy. The result is a

new breed of shopper – dubbed

“promiscuous” by one Sainsbury’s

exec for being the kind of people

who shop around, buy less at one

go but on a more frequent basis,

and (shock horror!) visit multiple

stores on one outing. But the

delinquency of these promiscuous

shoppers is still modest, relatively

speaking; recent research suggests

the average consumer frequents

just four separate grocers per

month. So, while some consumers

are revolutionising the food

economy by bed hopping between

supermarkets and independents,

for most people supermarkets

remain a regular haunt.

So is the supermarket model here

to stay, or will – and can – British

shoppers eventually jump ship

altogether? The escalating crisis

engulfing the Big Four appears to

suggest that the previous success

of Tesco, Sainsbury’s, Morrisons

and Asda is not due to the emotional

loyalty of its customers, but rather

to their resigned pragmatism.

Simply put, shoppers considered

supermarkets to be convenient

and cheap, and that was what kept

them coming back. You could do a

one-stop mammoth weekly shop in

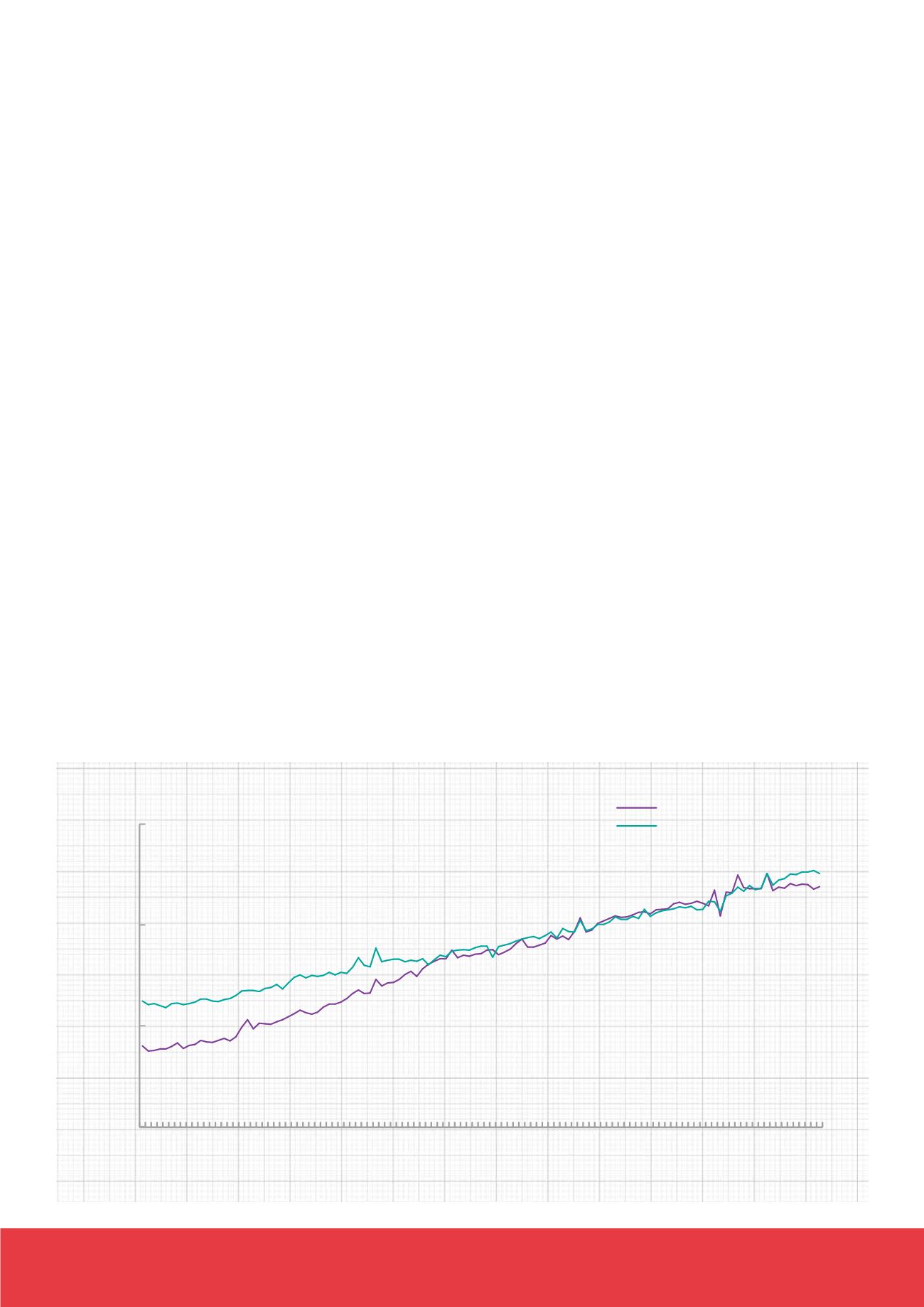

60

80

100

120

Non-specialised food stores

All retailing excluding fuel

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

Dec-13

Nov-13

Oct-13

Sep-13

Aug-13

Jul-13

Jun-13

May-13

Apr-13

Mar-13

Feb-13

Jan-13

Dec-12

Nov-12

Oct-12

Sep-12

Aug-12

Jul-12

Jun-12

May-12

Apr-12

Mar-12

Feb-12

Jan-12

Dec-11

Nov-11

Oct-11

Sep-11

Aug-11

Jul-11

Jun-11

May-11

Apr-11

Mar-11

Feb-11

Jan-11

Dec-10

Nov-10

Oct-10

Sep-10

Aug-10

Jul-10

Jun-10

May-10

Apr-10

Mar-10

Feb-10

Jan-10

Dec-09

Nov-09

Oct-09

Sep-09

Aug-09

Jul-09

Jun-09

May-09

Apr-09

Mar-09

Feb-09

Jan-09

Dec-08

Nov-08

Oct-08

Sep-08

Aug-08

Jul-08

Jun-08

May-08

Apr-08

Mar-08

Feb-08

Jan-08

Dec-07

Nov-07

Oct-07

Sep-07

Aug-07

Jul-07

Jun-07

May-07

Apr-07

Mar-07

Feb-07

Jan-07

Dec-06

Nov-06

Oct-06

Sep-06

Aug-06

Jul-06

Jun-06

May-06

Apr-06

Mar-06

Feb-06

Jan-06

Dec-05

Nov-05

Oct-05

Sep-05

Aug-05

Jul-05

Jun-05

May-05

Apr-05

Mar-05

Feb-05

Jan-05

Amount spent at non-specialist food stores and all retailers, 2004-2014

Source: Office for National Statistics, 23 October 2014

Year

Million (£)