ISSUES

: Business and Trade

Chapter 1: Business today

14

“Work till you drop” warning on pensions

Some people may have to work till they are 81 to build up a decent pension pot, according

to a report.

W

ith the Government carrying out a review of

the state pension age, research from Royal

London says an average earner who starts

saving for an occupational pension at 22, and makes

the minimum statutory contributions, would need to

work until 77 if they want the sort of “gold standard”

pension enjoyed by their parents.

Royal London defines this “gold standard”, which includes

the state pension, as two-thirds of pre-retirement income.

For those living in high-income areas, such asWestminster

and Wandsworth in London, achieving a pension pot of

this size would take till 80 or 81, assuming contributions

are not increased.

At the same time, a review for the Labour Party

has concluded that employees should double their

contributions to workplace schemes, with a target of 15

per cent of earnings going into pension pots.

Traditionally, the state pension age was 65 for men and 60

for women. This is being equalised and in two years’ time

it is due to rise, reaching 67 by 2028.

This could rise again as a result of a government review,

amid warnings that those starting work today could have

to wait until their mid-70s before they receive a state

pension.

Royal London’s research shows that how much people

need to save in occupational schemes, if they want a “gold

standard” pension, varies according to where they live.

Variations

While someone in Westminster who makes minimum

monthly contributions would have to wait till they are 81, a

worker in Boston, Lincolnshire, where incomes are lower,

would build up a big enough pot by 73.

Ages for Scotland, Wales and Northern Ireland are 77, 76

and 76, respectively.

Former pensions minister Steve Webb, who is director

of policy at Royal London, said: “It is great news that

millions more workers are being enrolled into workplace

pensions, but the amounts going in are simply not enough

to give people the kind of retirement they would want for

themselves, and certainly not the sort of pensions that

many of those retiring now are enjoying.

“Even in lower wage areas, people face working into their

early 70s to get a comfortable retirement. In higher wage

areas, the state pensionmakes amuch smaller contribution,

so workers in those areas face working well into their 70s.”

Mr Webb said the answer was to start saving early and

increase pension contributions.

2 March 2016

Ö

Ö

The above information is reprinted with kind permission

from

Channel 4 News

. Please visit

for further information.

© Channel 4 2016

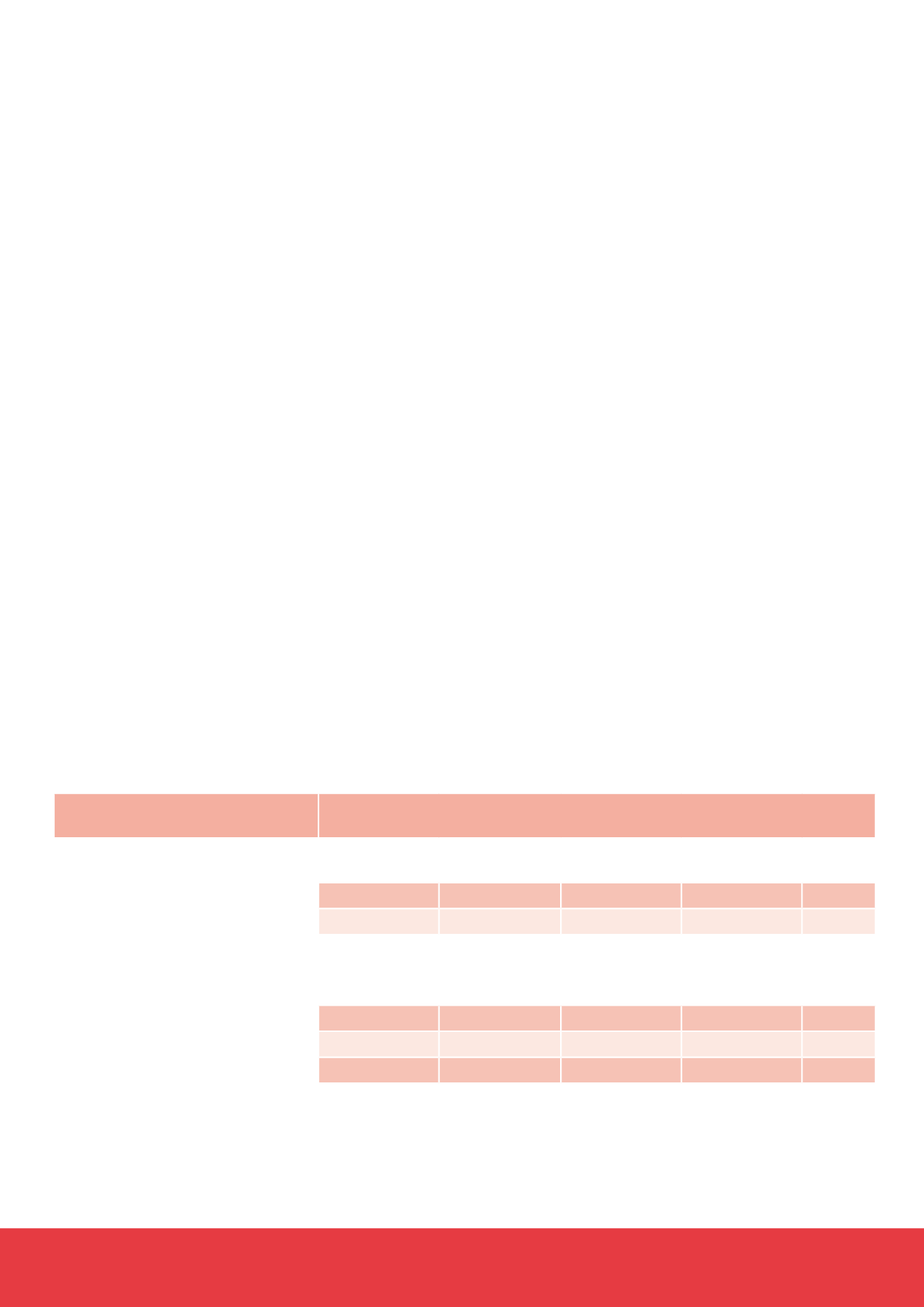

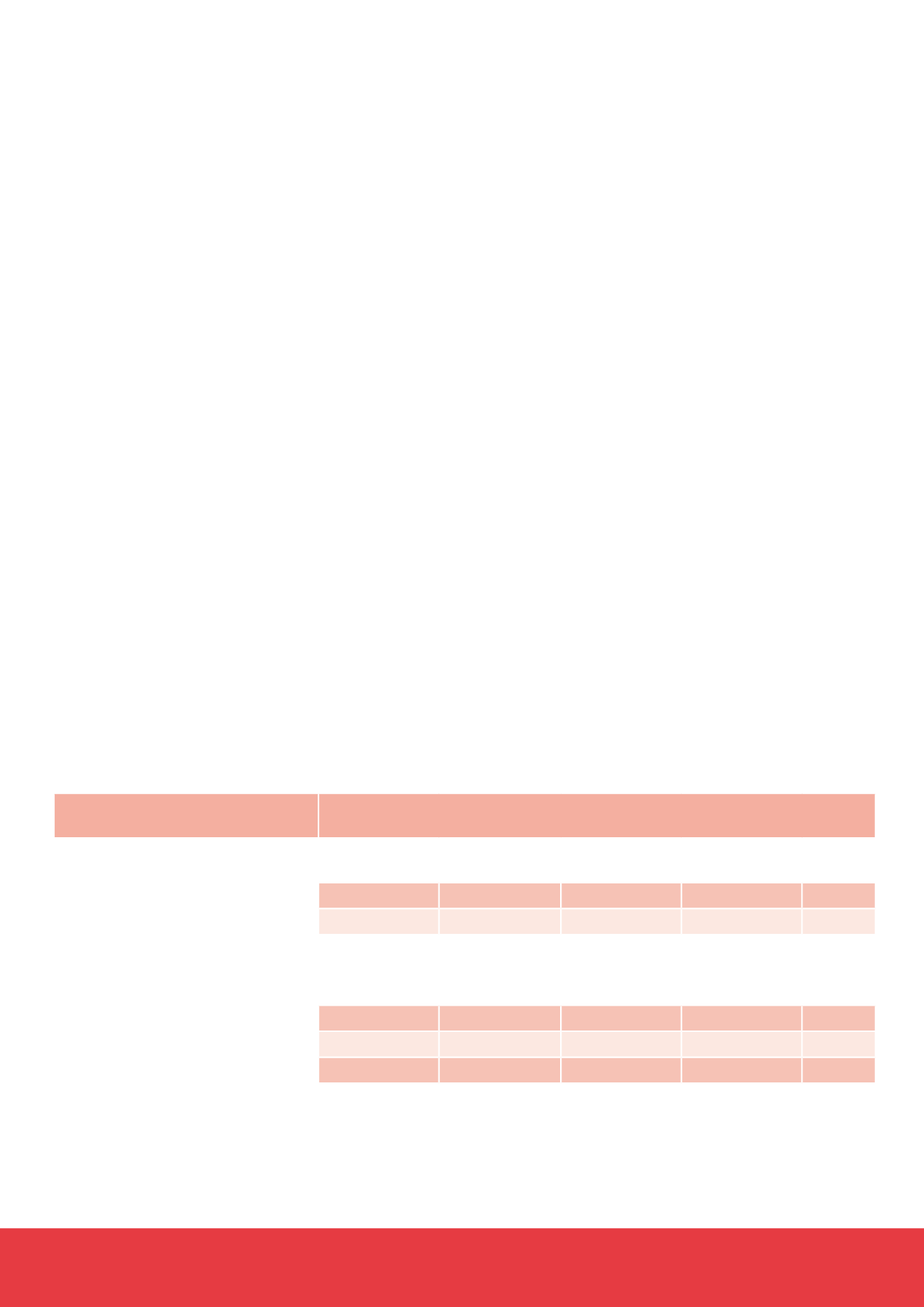

Personal pensions (including stakeholder pensions): scheme members’ annual

contributions

Numbers of members and value of contributions by type of scheme as reported to HMRC by providers for the yea

r.

Numbers: thousands Contributions: £ millions

6 April 2014 – 5 April 2015

Contributions

Employer sponsored schemes

Number of

members

Minimum

contributions

Individuals

contributions

1

Employer

contributions

Total

Contracted out members

2

140

0

100

280

380

Non-contracted out members

7,000

-

2,450

7,450 9,900

Non-employer sponsored

schemes

Contracted out members

2

with only minimum contributions

490

0

-

-

0

with minimum and other contributions

580

0

290

50

340

Non-contracted out members

3,740

-

6,180

3,220 9,400

Total

11,950

0

9,030

11,000 20,030

Footnotes

1.

Figures include basic rate tax relief repaid to scheme administrators by HM Revenue & Customs

2.

Number of members for contracted-out plans may include members with zero earnings who will not receive minimum

3.

Components may not sum to their total due to rounding.

“-” denotes nil or negligible or not applicable.

Source: Personal Pension Statistics, February 2016, HM Revenue & Customs