ISSUES

: Business and Trade

Chapter 1: Business today

16

located nearby to them; the crowd

then ‘herd’ towards firms who

obtain pre-seed funding. So in

many cases, equity crowdfunding

isn’t really a new or ‘alternative’

source of funding, but rather a

repackaging of more traditional

start-up funding.

As an Internet-mediated form of

funding, in theory, firms should be

able to access equity crowdfunding

irrespective of their geographical

location. In reality, however, there

seems to be a large ‘north-south’

divide in terms of successful deals,

with around half of all the deal flow

emanating from London and the

South East.

There are a number of potential

reasons for this. For example, the

majority of platforms are located

in London and we have found that

word-of-mouth referrals through

business networks are still very

important in both identifying and

accessing crowdfunding platforms.

Many businesses also want to

speak to platforms ‘in person’

before committing to a campaign

(rather than engaging virtually), and

so being within visiting distance of

a platform is important. So despite

the Internet-mediated nature of

crowdfunding, where distance

should be irrelevant, it is strongly

concentrated in the London and

the South East ecosystem. We

are currently exploring this trend

further.

Tip of the iceberg

Few non-professional investors

have the knowledge to undertake

their own due diligence on firms

before they invest nor do they

offer firms any additional value

(for example through advice or

support) on top of their financial

contribution. Indeed, some start-

ups have referred to the crowd

as “dumb money”.

Observers

have

also

questioned

the highly inflated

valuations of some

of the firms funded

through

equity

crowdfunding, many

of which are Internet-

based firms linked

to the so-called

‘sharing economy’,

and operating in

consumer-oriented

markets with no

intellectual property

or

recoverable

assets.

Given the high failure

rate of new start-

ups generally, and

the nature of most crowdfunded

businesses, few non-professional

investors are likely to see a return

on their investment any time soon.

Despite these reservations, given

the current growth trajectory of

equity crowdfunding, what we’ve

seen so far may just be the tip of the

iceberg. However, icebergs can sink

ships. While providing an important

source of start-up funding, equity

crowdfunding raises a number of

thorny issues in terms of investor

returns,

investor

protection,

sustainability and the need for

proper regulatory safeguards.

Crowdfunding has been heavily

promoted by organisations such

as Nesta, but the way it actually

works is strangely familiar. We

thus advocate a more critically

informed discussion about equity

crowdfunding, especially given

the UK’s heavily deregulated and

proactive fiscal policy environment

for this emerging source of

entrepreneurial finance.

16 December 2015

Ö

Ö

The above information is

reprinted with kind permission

from

The Conversation

. Please

visit

for further information.

© 2010–2016, The

Conversation Trust (UK)

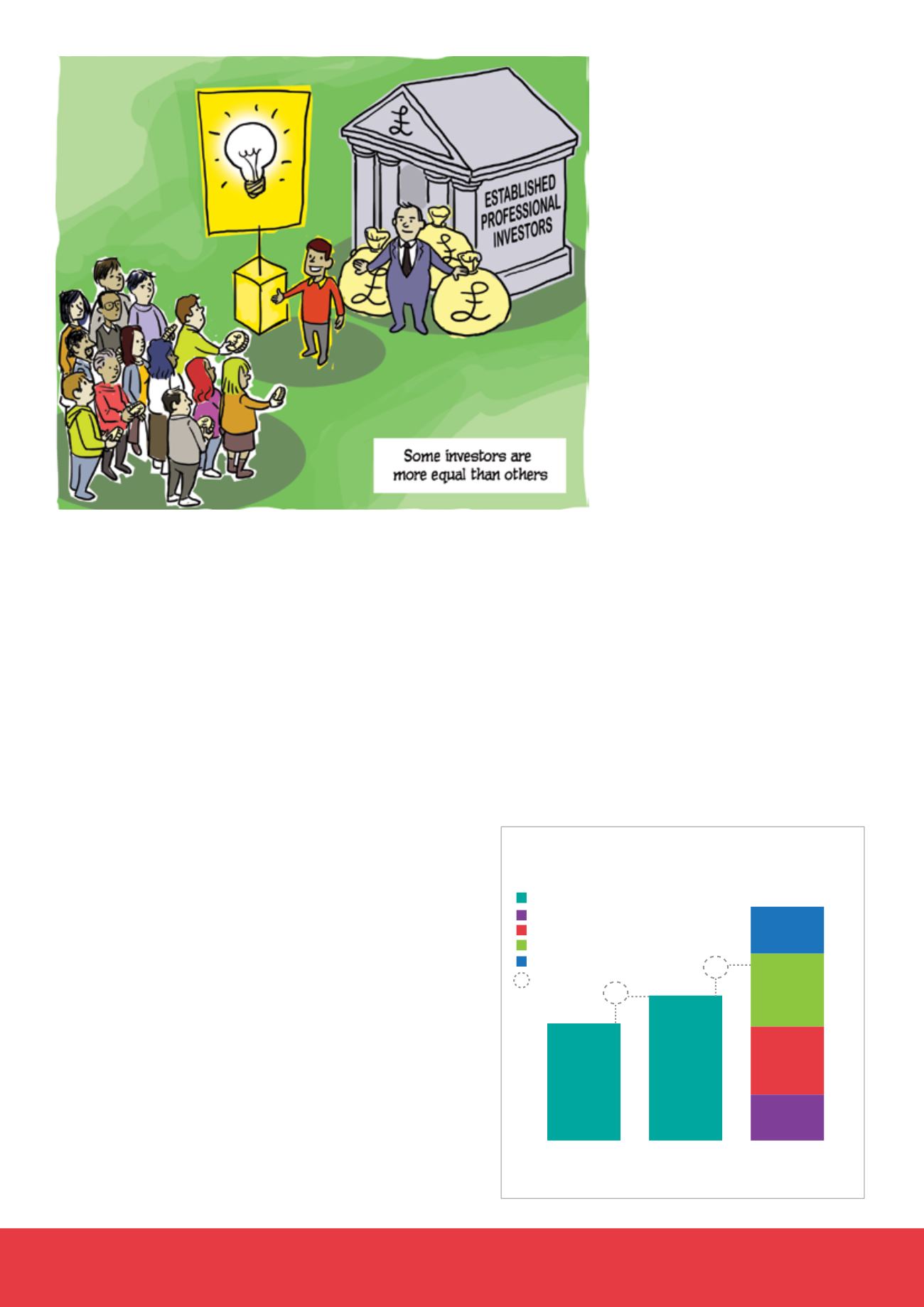

Reward-based crowdfunding market volume

by year and by quarter (2013 to 2015)

2013

£21m

£26m

£8.21m

£12.21m

£13.12m

£8.42m

2014

2015

£8.42m

All quarters

Q1

Q2

Q3

Q4

£41.96m

Growth rate

24%

61%

Source:

Pushing Boundaries, The 2015 UK Alternative Finance Industry Report

,

University of Cambridge Judge Business School & Nesta, February 2016