Crowded out: how crowdsourcing for startups turned into business as usual

Ross Brown, University of St Andrews and Suzanne Mawson, University of Stirling

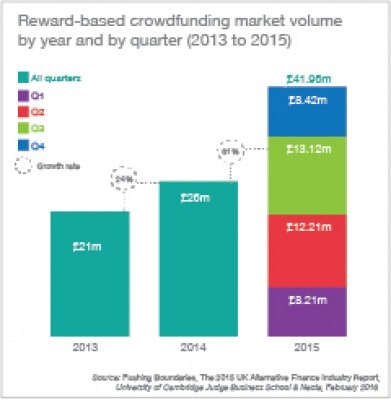

Crowdfunding has been hailed by some as the “democratisation of finance”. To many, it is viewed as a key alternative source of finance where we can all get involved in backing new companies through either donations or the purchase of equity. Unfortunately, it hasn’t quite worked out like that.

There are several new financing models that use the umbrella term of crowdfunding, but they can be fundamentally different. In theory, “equity” crowdfunding lets large numbers of small investors invest in firms via online platforms – or “mini stock markets” for start-ups – regardless of their location. From a business perspective, firms should be able to draw upon a wide range of funders in the crowd, who they might never have known existed, to fund, develop and grow their businesses.

What we’ve found is that equity crowdfunding isn’t as “new...

Want to see the rest of this article?

Would you like to see the rest of this article and all the other benefits that Issues Online can provide with?

- Useful related articles

- Video and multimedia references

- Statistical information and reference material

- Glossary of terms

- Key Facts and figures

- Related assignments

- Resource material and websites

Crowded out: how crowdsourcing for start-ups turned into business as usual

Crowded out: how crowdsourcing for start-ups turned into business as usual